Designed to streamline your financial transactions, this template offers a user-friendly interface and easy customization for all your credit memo needs. Whether you're a small business owner or a financial professional, our template is tailored to enhance your efficiency and professionalism.

Key Features:

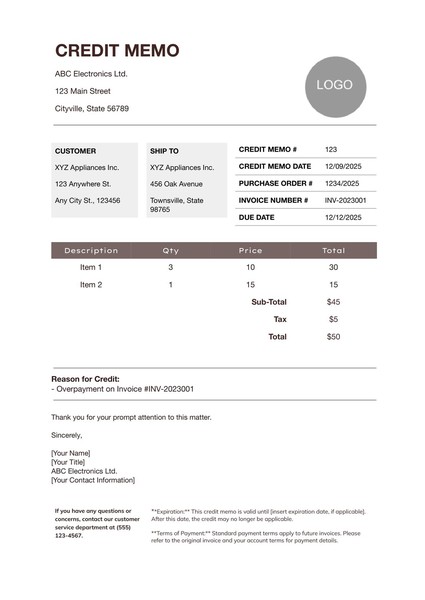

Professional Design: Impress clients and stakeholders with a sleek and professional layout. The template is designed to convey credibility and attention to detail.

User-Friendly Interface: No advanced technical skills required. The template is designed with a straightforward interface, making it accessible for users of all levels.

Comprehensive Details Section: Provide a detailed breakdown of goods or services, quantities, rates, and applicable taxes. The template allows for a thorough representation of the credit memo transaction.

Date and Invoice Number Tracking: Easily keep track of credit memos by including fields for the issuance date and a reference to the original invoice number.

Terms and Conditions: Ensure clarity by adding your specific credit memo terms and conditions. Clearly communicate policies related to returns, refunds, or adjustments.

Format: Google Docs

Contributed by: Alex Janovich

How to Use

Access the Template: Click the Download button to access the template. You need to be logged into your Google account.

Edit Fields: Replace placeholder text with your company's details, transaction information, and specific terms and conditions.

Save and Share: Once edited, save the document and share it digitally or print a hard copy for your records.

Guidelines for Writing an Effective Credit Memo

A well-crafted credit memo is crucial for maintaining transparent and professional financial transactions. Here are essential guidelines to pay attention to when writing a credit memo:

Accurate Information: Ensure all details in the credit memo are accurate and match the original transaction. This includes the customer's name, contact information, and the specific items or services being credited.

Clear Explanation: Provide a clear and concise explanation for issuing the credit memo. Whether it's due to product returns, pricing adjustments, or other reasons, clarity helps build trust with your clients.

Reference Original Invoice: Always reference the original invoice number in the credit memo. This creates a clear link between the credit issued and the initial transaction, helping both parties easily track the financial adjustment.

Detailed Line Items: Break down the credit amount into detailed line items, including quantities, rates, and applicable taxes. This transparency helps the recipient understand the basis for the credit and builds credibility.

Terms and Conditions: Clearly outline any terms and conditions associated with the credit memo. This may include expiration dates for the credit, conditions for returns, or any specific actions required by the customer to utilize the credit.

Professional Tone: Maintain a professional and courteous tone throughout the credit memo. Even if the credit is issued due to a mistake or an issue, maintaining professionalism helps preserve the business relationship.

Correct Formatting: Ensure the credit memo follows a consistent and professional format. Use a template or standard layout to maintain uniformity across all credit memos issued by your business.

Authorization and Signatures: Include the necessary authorizations and signatures on the credit memo. This ensures that the credit memo is recognized as an official document and can be legally binding.

Date and Validity: Clearly state the date of issuance on the credit memo. Additionally, if there's an expiration date for the credit, make sure it's communicated clearly to the customer.

Communication: Communicate with the customer regarding the credit memo. Whether through email, a cover letter, or a separate communication, inform the customer about the credit, why it was issued, and any actions they need to take.

Record-Keeping: Maintain organized records of all credit memos issued. This is essential for internal accounting purposes and can also serve as a reference in case of any disputes or inquiries.

By adhering to these guidelines, you can create credit memos that not only rectify financial discrepancies but also contribute to a positive and transparent business relationship with your clients.