Feeling overwhelmed by debt can be stressful, but creating a clear plan is the first step towards financial freedom. Our collection of free Debt Management Google Sheets templates provides powerful tools to help you understand your obligations, strategize your repayment, and track your progress systematically. These templates are designed to empower you with the information needed to make informed decisions and accelerate your debt payoff journey.

Benefits of Using Debt Management Templates

Strategic Repayment: Implement proven strategies like the Debt Avalanche (highest interest first to save money) or Debt Snowball (smallest balance first for motivation) methods.

Visualize Progress: See exactly how each payment reduces your balances and brings you closer to your goal. This can be highly motivating.

Interest Savings: Understand how different payment approaches can impact the total interest you pay over the life of your loans. Templates can help illustrate potential savings.

Centralized Information: Keep all your debt details — balances, interest rates, minimum payments, and payoff schedules — organized in one accessible place.

Motivation & Focus: Having a clear, actionable plan makes the often daunting task of debt repayment feel more manageable and keeps you focused.

Key Elements of an Effective Debt Management Template (like our Debt Avalanche Planner)

Comprehensive Debt Listing: A section to input details for each debt (name, current balance, APR, minimum payment).

Prioritization Logic: Automatic sorting or clear guidance on how to order debts based on the chosen strategy (e.g., highest APR for avalanche).

Payment Allocation Plan: Clear indication of how much to pay on each debt monthly, including how extra payments are applied.

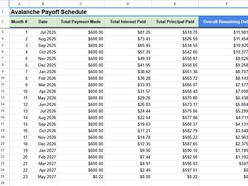

Month-by-Month Amortization: A detailed schedule showing the breakdown of each payment into principal and interest, and the declining balance for each debt over time.

Payoff Projections: Estimates of when each debt, and all debts combined, will be fully paid off.

Summary Dashboard: An overview of total debt, total interest projected, and time to debt freedom.

Whether you're tackling credit card debt, student loans, or other obligations, these Google Sheets templates offer a structured and insightful way to manage and eliminate your debt effectively. Select a template, input your information, and start your journey towards a debt-free future.